Mastering Forex Trading: Strategies, Tools, and Insights

Forex trading, or foreign exchange trading, has gained immense popularity among investors and traders worldwide. Whether you’re a seasoned investor or just starting, understanding the fundamentals of forex can significantly enhance your trading experience. In this article, we will explore the essential aspects of forex trading and provide valuable insight into how to succeed in this dynamic market. For those interested in exploring options for trading, check out forex and trading Forex Brokers in Cambodia.

What is Forex Trading?

Foreign exchange trading involves the buying and selling of currencies under the current market rules and conditions. It operates on the principle of currency pairs: when you buy a currency, you are simultaneously selling another. For instance, if you believe that the Euro will strengthen against the US Dollar, you would buy the EUR/USD currency pair. Forex is one of the largest financial markets in the world, with daily trading volumes exceeding $6 trillion.

Understanding the Forex Market

The forex market is decentralized, meaning that it operates globally over-the-counter (OTC) and does not have a centralized exchange like stock markets. It operates 24 hours a day, five days a week, allowing traders to engage in forex trading at any time. The market is divided into various sections, including the interbank market, retail market, and futures market.

Major Currency Pairs

Understanding currency pairs is fundamental in forex trading. Here are some major pairs:

- EUR/USD: Euro vs. US Dollar

- USD/JPY: US Dollar vs. Japanese Yen

- GBP/USD: British Pound vs. US Dollar

- AUD/USD: Australian Dollar vs. US Dollar

- USD/CHF: US Dollar vs. Swiss Franc

Each currency pair has unique characteristics affected by various factors, including economic data, political events, and market sentiment.

Choosing a Forex Broker

Selecting the right forex broker is crucial for successful trading. Here are some factors to consider when choosing a broker:

- Regulation: Ensure the broker is regulated by recognized authorities to guarantee the safety of your funds.

- Trading Platform: Choose a user-friendly trading platform with the tools and resources needed for analysis.

- Spreads and Fees: Compare spreads and commission fees among different brokers to find the best deal.

- Customer Support: Check for responsive customer service to assist you with any issues.

- Education and Research: A broker offering quality educational resources can help improve your trading skills.

Trading Strategies

Developing a solid trading strategy is vital for success in forex trading. Below are some widely-used strategies:

- Scalping: A short-term strategy aimed at profiting from small price changes.

- Day Trading: Involves opening and closing trades within the same day to take advantage of market fluctuations.

- Swing Trading: A medium-term strategy aimed at capturing price movements over several days or weeks.

- Position Trading: A long-term strategy focused on holding trades for an extended period based on market fundamentals.

Each strategy has its own set of risks and rewards, so it’s important to find one that suits your trading style and risk tolerance.

Technical and Fundamental Analysis

Successful forex trading requires a sound understanding of both technical and fundamental analysis.

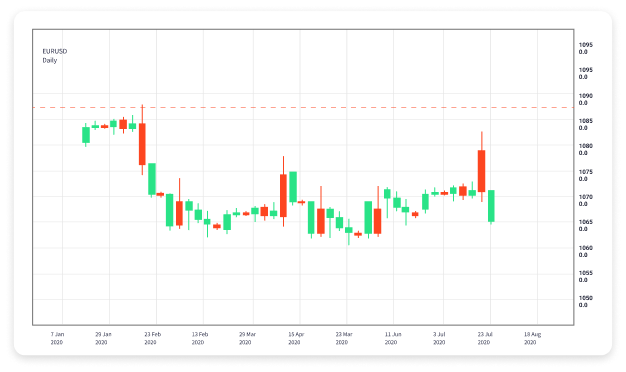

Technical Analysis: This involves analyzing historical price movements and patterns using charts and indicators. Technical traders look for trends, support and resistance levels, and various chart patterns to make informed decisions.

Fundamental Analysis: This approach focuses on evaluating economic, political, and social factors that can affect currency values. Traders analyze economic indicators such as GDP, employment rates, inflation, and geopolitical events to predict future movements in currency pairs.

Risk Management in Forex Trading

Managing risk is a fundamental aspect of trading that should not be overlooked. Here are several strategies to implement effective risk management:

- Apply Stop-Loss Orders: Set stop-loss orders to limit potential losses on trades.

- Risk-Reward Ratio: Maintain a favorable risk-reward ratio by predicting potential gains against possible losses.

- Position Sizing: Determine the size of your trades based on your trading capital and risk tolerance.

- Diversification: Spread your investments across various currency pairs to reduce exposure to any single currency’s fluctuations.

Conclusion

Forex trading can be both rewarding and challenging. By understanding the market’s intricacies, choosing the right brokers, employing effective strategies, and managing risks, traders can enhance their chances of success. Continuous learning and adaptation to market changes are essential components of a successful forex trading journey. Whether you’re a novice or an experienced trader, the world of forex offers endless opportunities for growth and profit.

موقع مدرسة طلخا المتميزة للغات2

موقع مدرسة طلخا المتميزة للغات2